Market Report February 2025

- Mark

- Mar 28

- 4 min read

REXIG SUMMARY

Housing Market February 2025: Affordability Holds Back Buyers as Trade Uncertainty Looms

Homebuyers in the Greater Toronto Area (GTA) continued to benefit from an inventory-rich market in February 2025. However, elevated borrowing costs and growing concerns around economic stability—particularly surrounding trade relationships—contributed to subdued home sales activity. Despite the abundance of choice, many buyers appear to be waiting for further clarity before making a move.

Key Highlights – February 2025

Home Sales:

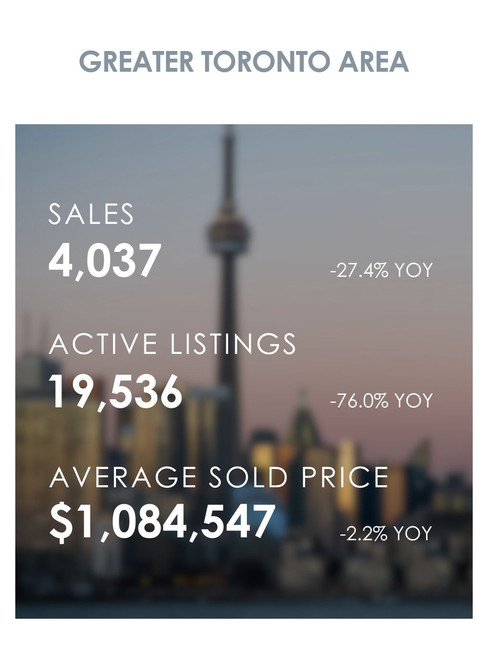

A total of 4,037 homes were sold in February, marking a 27.4% decline compared to February 2024. On a seasonally adjusted basis, sales were also down compared to January 2025.

New Listings:

New listings rose 5.4% year-over-year, reaching 12,066, reflecting strong seller confidence and contributing to a well-supplied market.

Pricing Trends:

The MLS® HPI Composite Benchmark declined 1.8% year-over-year, and the average selling price fell 2.2%, settling at $1,084,547. Both metrics edged lower on a month-over-month basis after seasonal adjustment.

Market Insights

Buyers remain active but cautious. With borrowing costs still elevated, many households are finding it difficult to qualify for a mortgage that aligns with current home prices. The anticipation of rate cuts later this year may encourage more buyers back into the market—but for now, many are waiting on the sidelines.

Additionally, growing uncertainty around Canada’s trade relationship with the United States is dampening consumer confidence. If clarity on trade and economic policy emerges, and borrowing costs decline as expected, we could see more meaningful momentum in the second half of 2025.

Focus on Affordability, Confidence, and Policy

The current environment highlights the need for:

- Clear policy direction around housing supply and affordability

- Leadership that tackles economic and trade uncertainty

- Renewed focus on increasing housing diversity (including missing-middle and purpose-built rental options)

Consumer confidence will play a critical role in shaping the market trajectory this year.

Future Outlook

The GTA housing market is expected to remain in a state of balance over the coming months. While lower interest rates are projected to improve affordability, short-term buyer hesitancy could persist due to economic and policy uncertainty.

A stronger second half of the year is possible—provided borrowing costs ease and households gain confidence in the broader economy. Long-term affordability, however, will depend on sustained efforts to increase supply, support diverse housing types, and remove systemic barriers in the housing sector.

REGIONAL SPOTLIGHT // FEBRUARY 2025 Mississauga Region Real Estate Market Report

The latest data from the Cornerstone Association of REALTORS® reveals that Mississauga’s housing market remained under pressure in February 2025, with continued sluggishness in sales despite a healthy rise in new listings and inventory. Buyers appear hesitant to return in full force, even as more options become available, leading to a more pronounced shift into buyer-friendly conditions.

While affordability has improved slightly and prices have generally softened, concerns over the recently escalated trade war with the U.S. are starting to loom larger. Mississauga, home to many businesses connected to U.S. supply chains, could see consumer confidence impacted if the trade situation persists or worsens.

Despite these headwinds, the market is showing signs of rebalancing—with buyers gaining more leverage and pricing becoming more negotiable.

Home Sales Drop Sharply in February 2025

- Home Sales: Only 333 homes were sold in February 2025, down 29.9% compared to February 2024.

- Historical Comparison: Sales were 45.7% below the 5-year average and 47.3% below the 10-year average for February.

- Year-to-Date: A total of 679 homes were sold over the first two months of 2025, down 20.2% compared to the same period last year.

Prices Show Mixed Signals

- Average Price: The average price of homes sold in February was $1,039,951—up 4.4% year-over-year.

- Year-to-Date Average Price: $1,043,556, a 2.4% increase from early 2024.

MLS® Home Price Index (HPI):

- Overall Benchmark Price: $1,049,600 (down 2.1% from last year)

- Single-Family Homes: $1,337,000 (down 2.7%)

- Townhouses/Row Units: $809,000 (down 2.9%)

- Apartments: $598,700 (down 7.4%)

More Homes on the Market

- New Listings: 1,049 new listings hit the market in February 2025, up 11% year-over-year—the highest level in over a decade for February.

- Active Listings: 1,695 active residential listings at month-end, up a staggering 77.9% from February 2024.

- Historical Context: Active listings are 81.5% above the 5-year average and 89% above the 10-year average.

- Months of Inventory: 5.1 months, up from 2 months last February and well above the long-term February average of 1.7 months.

What This Means

Mississauga’s housing market is clearly shifting in favour of buyers. With more listings, longer time on the market, and steady-to-declining benchmark prices, buyers now have more options—and more bargaining power.

That said, the market remains cautious. The trade war initiated by the U.S. may lead to uncertainty in key sectors tied to Mississauga’s economy, potentially affecting job security, sentiment, and demand.

REXIG Summary

- Home sales declined significantly in February 2025.

- Prices were stable to slightly down, with average prices up but benchmark prices showing mild declines.

- Inventory rose sharply, giving buyers more options than they’ve had in over a decade.

- The market favours buyers, but external factors like trade policy could influence how the rest of the year unfolds.

Read here to read our economic update for last month.

ECONOMIC SPOTLIGHT

NEWS

Recovery In Sight, But Buyers Hold The Cards

As valued clients of REXIG Realty, we are excited to provide you with our latest Real Estate Market Report

for the Greater Toronto Area & surrounding regions.

Our goal is to keep you informed and empowered with the most up-to-date information to make

informed decisions regarding your real estate investments.